CPA vs ROAS: Choosing the Right Primary Metric for Your Campaigns

When launching a new advertising campaign, one of the most critical decisions you'll make is choosing your primary optimization metric. Should you optimize for Cost Per Acquisition (CPA) or Return on Ad Spend (ROAS)? This choice fundamentally shapes how algorithms bid, what audiences they target, and ultimately, whether your campaigns drive profitable growth.

The difference between CPA and ROAS optimization isn't just semantic. These metrics represent fundamentally different approaches to campaign success. CPA focuses on controlling costs per conversion, ideal for businesses where every lead or sale has similar value. ROAS focuses on maximizing revenue return, essential for businesses with variable order values or product margins.

Making the wrong choice can mean leaving thousands of dollars on the table or burning through budget on unprofitable conversions. This guide will help you understand when to use each metric, how they impact campaign performance differently, and how to set the right optimization goal for your specific business model.

Understanding CPA and ROAS Definitions

Before diving into strategy, let's establish clear definitions of each metric and how they're calculated.

Cost Per Acquisition (CPA) measures how much you spend to acquire a single conversion. The formula is straightforward: CPA = Total Ad Spend ÷ Total ConversionsFor example, if you spend $1,000 and generate 50 conversions, your CPA is $20. This metric tells you exactly what each customer or lead costs to acquire through advertising.

Return on Ad Spend (ROAS) measures how much revenue you generate for every dollar spent on advertising. The formula is: ROAS = Total Revenue ÷ Total Ad SpendIf you spend $1,000 and generate $4,000 in revenue, your ROAS is 4:1 (or 400%). This metric tells you how efficiently your advertising converts spend into revenue.

The fundamental difference? CPA is cost-focused while ROAS is revenue-focused. CPA asks "How much does a conversion cost?" while ROAS asks "How much revenue does my ad spend generate?"

Use our CPA Calculator to quickly calculate your cost per acquisition across campaigns, or our ROAS Calculator to measure your return on ad spend.

Why the Distinction Matters

Consider two scenarios with identical ad spend of $1,000:

Scenario A: 100 conversions at $50 average order value- CPA: $10 (excellent)

- ROAS: 5:1 (good)

- Total Revenue: $5,000

- CPA: $20 (worse than A)

- ROAS: 6:1 (better than A)

- Total Revenue: $6,000

If you optimize for CPA, algorithms will prefer Scenario A. If you optimize for ROAS, they'll prefer Scenario B. Scenario B generates more revenue and profit despite higher CPA, yet CPA optimization would push you toward less profitable results.

This illustrates why choosing the right metric matters: your optimization goal directly influences which customer segments, products, and strategies the algorithm pursues.

When to Optimize for CPA

CPA optimization works best when conversion values are consistent and your primary goal is controlling acquisition costs. Here are the scenarios where CPA should be your primary metric:

1. Lead Generation Businesses

If you're generating leads for services like legal, insurance, real estate, or B2B sales, CPA optimization is typically the right choice. Why? Because each lead has similar potential value, and your business model requires a specific cost threshold to remain profitable.

For example, if your insurance agency converts 10% of leads at an average customer lifetime value of $2,000, you know you can afford up to $200 per lead while maintaining profitability. Setting a target CPA of $150 gives you buffer and ensures sustainable growth.

Lead generation businesses should optimize for CPA when:

- Lead quality is relatively consistent

- Sales teams can handle varying lead volumes

- Lifetime value is similar across customer segments

- The primary constraint is lead cost, not lead volume

2. Subscription Services with Fixed Pricing

SaaS companies and subscription businesses with single-tier or similar pricing should often optimize for CPA. When your product costs $99/month regardless of customer, and conversion rates from trial to paid are consistent, CPA provides the clearest path to profitability.

A project management SaaS with $99/month pricing and 40% trial-to-paid conversion knows each trial signup is worth approximately $40 in first-month revenue. If customer lifetime value averages $500, they can set target CPAs around $100-150 and scale confidently.

3. New Campaigns Without Revenue Tracking

When you're just starting out and haven't implemented proper revenue tracking, CPA is often the only viable optimization metric. You can track conversions (signups, downloads, purchases) even without tracking order values.

Starting with CPA optimization allows you to:

- Launch campaigns faster without complex tracking setup

- Establish baseline conversion costs

- Gather data before transitioning to ROAS optimization

- Test audience and creative performance economically

4. Campaigns with External Value Attribution

Some conversions have value determined outside the advertising platform. For example, phone call conversions for high-ticket services, demo bookings for enterprise software, or store visits for retail businesses.

When conversion value is realized offline or the sales cycle is long and complex, CPA provides a more practical optimization target. You can set CPA targets based on historical close rates and customer values.

5. Budget-Constrained Scaling

If your budget is limited and you need to maximize conversion volume within strict cost constraints, CPA optimization ensures you stay within budget while generating as many conversions as possible.

Early-stage startups or businesses with tight margins often benefit from CPA optimization because it prevents overspending while building initial customer base and gathering market data.

When to Optimize for ROAS

ROAS optimization is the better choice when conversion values vary significantly and your goal is maximizing profitable revenue. Here's when to use ROAS as your primary metric:

1. Ecommerce with Variable Order Values

Online stores with diverse product catalogs and varying order values should almost always optimize for ROAS. When customers might buy a $25 item or a $500 item, optimizing for CPA would treat these conversions equally, leading to poor revenue outcomes.

ROAS optimization guides algorithms to:

- Prioritize higher-value products and customers

- Adjust bids based on likelihood of larger orders

- Focus on audience segments with higher average order values

- Balance volume with revenue quality

For example, a fashion retailer might see CPA of $30 across the board, but ROAS reveals that some campaigns generate 8:1 returns while others deliver only 2:1, despite identical CPAs.

2. Businesses with High Margin Variation

If your products or services have dramatically different profit margins, ROAS optimization (combined with profit margin awareness) prevents wasteful spending on low-margin conversions.

Consider a electronics retailer:

- Accessories: 60% margin, $40 average sale

- Laptops: 15% margin, $800 average sale

- Smart home devices: 35% margin, $200 average sale

Without ROAS optimization, the algorithm might drive accessory sales (good margins but low revenue) while missing laptop sales (lower margin percentage but much higher dollar profit). ROAS optimization balances revenue generation with conversion efficiency.

3. Established Campaigns with Revenue Data

Once you've implemented proper revenue tracking and accumulated sufficient conversion data, transitioning from CPA to ROAS optimization usually improves profitability. With revenue data, algorithms can make much smarter bidding decisions.

Making this transition typically requires:

- At least 30 conversions with revenue values tracked

- Consistent revenue tracking for 2-4 weeks

- Revenue data passing correctly to ad platforms

- Understanding of your profit margins and target ROAS

4. Businesses Focused on Revenue Growth

If your primary business objective is revenue growth rather than customer acquisition volume, ROAS is the right metric. This is common for established ecommerce brands, businesses with strong product-market fit, or companies prioritizing top-line growth.

ROAS optimization ensures every dollar spent contributes maximally to revenue goals. While you might acquire fewer total customers, the customers you acquire generate more revenue and often more profit.

5. Seasonal or Promotional Campaigns

During high-stakes periods like Black Friday, holiday sales, or major promotions, ROAS optimization helps maximize revenue when it matters most. You're not just trying to acquire customers efficiently; you're trying to capture as much revenue as possible during peak shopping periods.

ROAS optimization during these windows:

- Capitalizes on increased purchase intent

- Adjusts bids for higher-value shopping behavior

- Prioritizes revenue over strict efficiency

- Maximizes promotional period impact

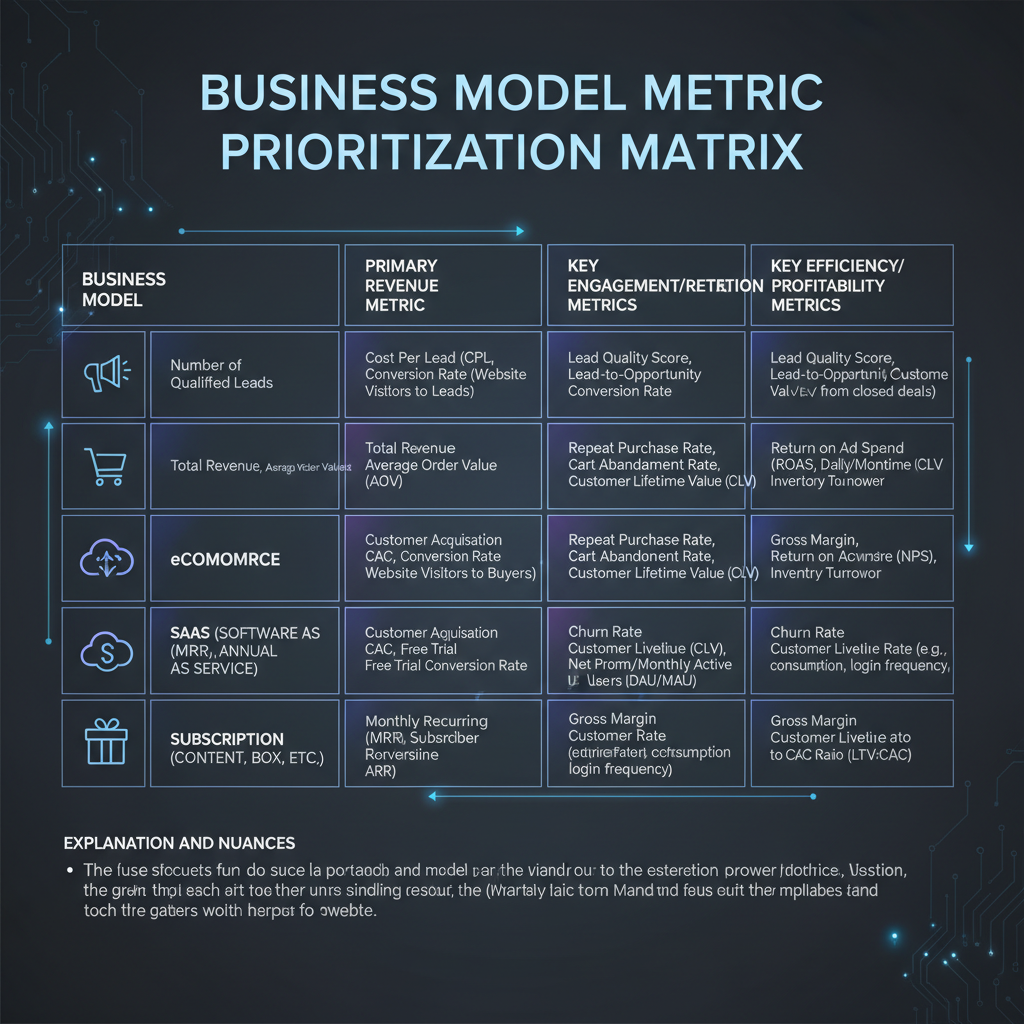

Business Models and Metric Selection

Different business models naturally align with different primary metrics. Here's how to choose based on your business type:

Lead Generation → CPA Primary

Industries: Legal services, insurance, real estate, B2B services, financial services, home services Why CPA: Consistent lead values, offline sales process, similar conversion characteristics, cost control is critical Target Setting: Base CPA targets on percentage of customer lifetime value (typically 10-30% of LTV) Example: Personal injury law firm with $5,000 average case value should target $500-1,500 CPA depending on conversion rates and marginsEcommerce → ROAS Primary

Industries: Retail, fashion, electronics, home goods, beauty, consumer products Why ROAS: Variable order values, diverse product catalogs, repeat purchase potential, revenue growth focus Target Setting: Set ROAS based on profit margins (breakeven ROAS = 1 ÷ profit margin as decimal) Example: Fashion brand with 45% average margin needs minimum 2.22 ROAS to break even, should target 3-4 ROAS for profitabilitySaaS (Single Tier) → CPA Primary

Industries: Software with consistent pricing, subscription apps, productivity tools Why CPA: Fixed subscription values, consistent conversion value, CAC-to-LTV ratio focus Target Setting: Set CPA at 20-30% of first-year customer value or 10-15% of lifetime value Example: $50/month SaaS with $600 annual value should target $120-180 CPA for new customer acquisitionSaaS (Multi-Tier) → ROAS Primary

Industries: Enterprise software, tiered SaaS products, usage-based pricing Why ROAS: Variable plan values, upsell potential, account expansion, total contract value varies Target Setting: Set ROAS based on average first-year revenue and target CAC payback period Example: SaaS with plans from $99-999/month should optimize for ROAS to capture higher-tier customersSubscription Boxes → ROAS Primary

Industries: Meal kits, beauty boxes, subscription services with variable tiers Why ROAS: Multiple subscription levels, varied customer lifetime patterns, retention-focused growth Target Setting: Calculate ROAS targets based on first-order value plus expected lifetime value over 6-12 months Example: Meal kit service should include first order plus expected 3-month retention value in ROAS calculationsMarketplace/Aggregator → Hybrid Approach

Industries: Marketplaces, aggregators, platforms connecting buyers and sellers Why Hybrid: Transaction values vary widely, some actions have immediate value (purchases), others have long-term value (registrations) Target Setting: Use CPA for user acquisition, ROAS for transaction campaigns Example: Travel marketplace uses CPA for new user signups, ROAS for booking-focused campaignsCampaign Stages and Metric Evolution

Your optimal metric often changes as campaigns mature. Understanding this evolution helps you make strategic adjustments at the right time.

Stage 1: Campaign Launch (Weeks 1-2) → CPA

When launching new campaigns, start with CPA optimization even if ROAS will be your eventual goal. Why?

- Limited data makes ROAS optimization less effective

- Need to establish baseline conversion costs

- Easier to control initial spending

- Faster learning phase with clearer target

Stage 2: Initial Optimization (Weeks 3-6) → CPA or Transitional

As data accumulates, you can refine CPA targets or begin preparing for ROAS transition.

- Analyze conversion value variation

- Verify revenue tracking accuracy

- Calculate actual ROAS from CPA campaigns

- Identify if value variation justifies ROAS shift

Stage 3: Mature Performance (Weeks 7+) → Optimal Metric

With sufficient data, switch to the metric that best aligns with your business model.

For ecommerce and variable-value businesses:

- Transition to ROAS optimization

- Set targets based on profit margins

- Monitor both ROAS and CPA as secondary metrics

- Adjust bids to balance volume and revenue

For lead generation and consistent-value businesses:

- Continue CPA optimization

- Refine targets based on backend conversion data

- Track revenue per lead as secondary metric

- Optimize bidding for lead quality indicators

Stage 4: Scaling (Ongoing) → Primary Metric with Secondary Guardrails

As you scale, your primary metric drives optimization, but secondary metrics act as guardrails.

ROAS-optimized campaigns should monitor:- CPA (to ensure scaling doesn't inflate costs unreasonably)

- Conversion volume (to catch when ROAS improves but volume drops)

- Customer acquisition cost relative to lifetime value

- Total revenue generated (to ensure volume growth drives revenue growth)

- Average order value or lead value (to catch quality degradation)

- Backend conversion rates (to verify lead quality remains strong)

Platform Optimization Differences

Different platforms handle CPA vs ROAS optimization with varying sophistication. Understanding these differences helps set realistic expectations.

Meta (Facebook/Instagram)

Meta's algorithm is highly optimized for both CPA and ROAS, but each works differently:

CPA Optimization:- Called "Cost Cap" or "Cost Per Result Goal"

- Algorithm bids to maintain target CPA

- Works well with 50+ conversions per week

- Provides consistent costs but variable revenue

- Called "Value Optimization" with ROAS goal

- Requires revenue tracking via pixel or Conversions API

- Needs 50+ purchase events per week with revenue values

- Actively bids higher for signals indicating higher-value customers

Google Ads

Google offers sophisticated options for both metrics:

CPA Optimization:- "Target CPA" bidding strategy

- Works across Search, Display, Shopping, YouTube

- Effective with 30+ conversions per month minimum

- Very stable for lead generation campaigns

- "Target ROAS" bidding strategy

- Requires transaction-specific values

- Works exceptionally well for Shopping campaigns

- Needs 50+ conversions with value data per month

TikTok

TikTok's optimization is newer and less sophisticated than Meta or Google:

CPA Optimization:- "Cost Cap" or "Lowest Cost" with CPA goal

- Requires minimum 50 conversions per week

- Less stable than Meta or Google

- Works better for consideration objectives (add to cart, lead forms)

- "Value Optimization" available but data-hungry

- Requires 100+ purchase events with revenue per week

- Can be volatile without significant scale

- Best for established accounts with proven creative

Amazon Advertising

Amazon's unique position as both ad platform and retailer enables sophisticated ROAS optimization:

ACoS (Advertising Cost of Sale):- Amazon's version of ROAS (inverse relationship)

Target ACoS of 20% = ROAS of 5:1- Automatically optimizes for profitable revenue

- Works at any scale due to Amazon's data

Using Both Metrics Together

The most sophisticated approach isn't choosing CPA or ROAS exclusively but using both strategically based on campaign purpose and funnel position.

Funnel-Based Metric Assignment

Top of Funnel (Awareness):- Metric: CPA for engagement actions (video views, page views, landing page visits)

- Goal: Efficient reach and initial interest

- Example: $2 CPA for landing page visits

- Metric: CPA for consideration actions (add to cart, content views, lead forms)

- Goal: Building qualified audience pools for retargeting

- Example: $15 CPA for add to cart events

- Metric: ROAS for purchase campaigns (for ecommerce) or CPA for conversion campaigns (for lead gen)

- Goal: Profitable conversions

- Example: 4:1 ROAS for purchase campaigns or $50 CPA for qualified leads

Dual Metric Monitoring

Even when optimizing for one primary metric, always monitor the other as a health check:

Primary ROAS campaigns should track:- CPA to ensure you're not overpaying for conversions

- If CPA increases 30%+ while ROAS stays flat, you may be reaching audience saturation

- If CPA decreases while ROAS improves, you're in healthy scaling territory

- Revenue per conversion to ensure value isn't declining

- If CPA stays flat but revenue per conversion drops, lead/customer quality may be degrading

- If CPA decreases and revenue per conversion increases, you've found optimization opportunities

Budget Allocation Strategy

Allocate budgets across campaigns with different metric focuses:

Example Ecommerce Allocation:- 60% of budget: ROAS-optimized purchase campaigns (target: 4:1 ROAS)

- 25% of budget: CPA-optimized add-to-cart retargeting (target: $25 CPA)

- 15% of budget: CPA-optimized prospecting for audience building (target: $5 CPA for landing page views)

- 70% of budget: CPA-optimized lead campaigns (target: $40 CPA)

- 20% of budget: CPA-optimized consideration campaigns (target: $8 CPA for content downloads)

- 10% of budget: ROAS-optimized campaigns for high-value lead sources (target: 3:1 ROAS based on closed deal values)

Testing Metric Changes

When transitioning between metrics, use systematic testing:

- Duplicate your best-performing campaign

- Keep one on current optimization (control)

- Switch duplicate to new optimization metric (test)

4. Run both for 2-4 weeks with equal budgets

5. Compare total performance: conversions, revenue, CPA, ROAS

6. Scale the winner and gradually shift budget

This approach prevents premature optimization changes while gathering clear data on which metric drives better business results.

Setting the Right Optimization Goal

Choosing between CPA and ROAS isn't just about understanding the metrics; it's about aligning advertising strategy with business objectives.

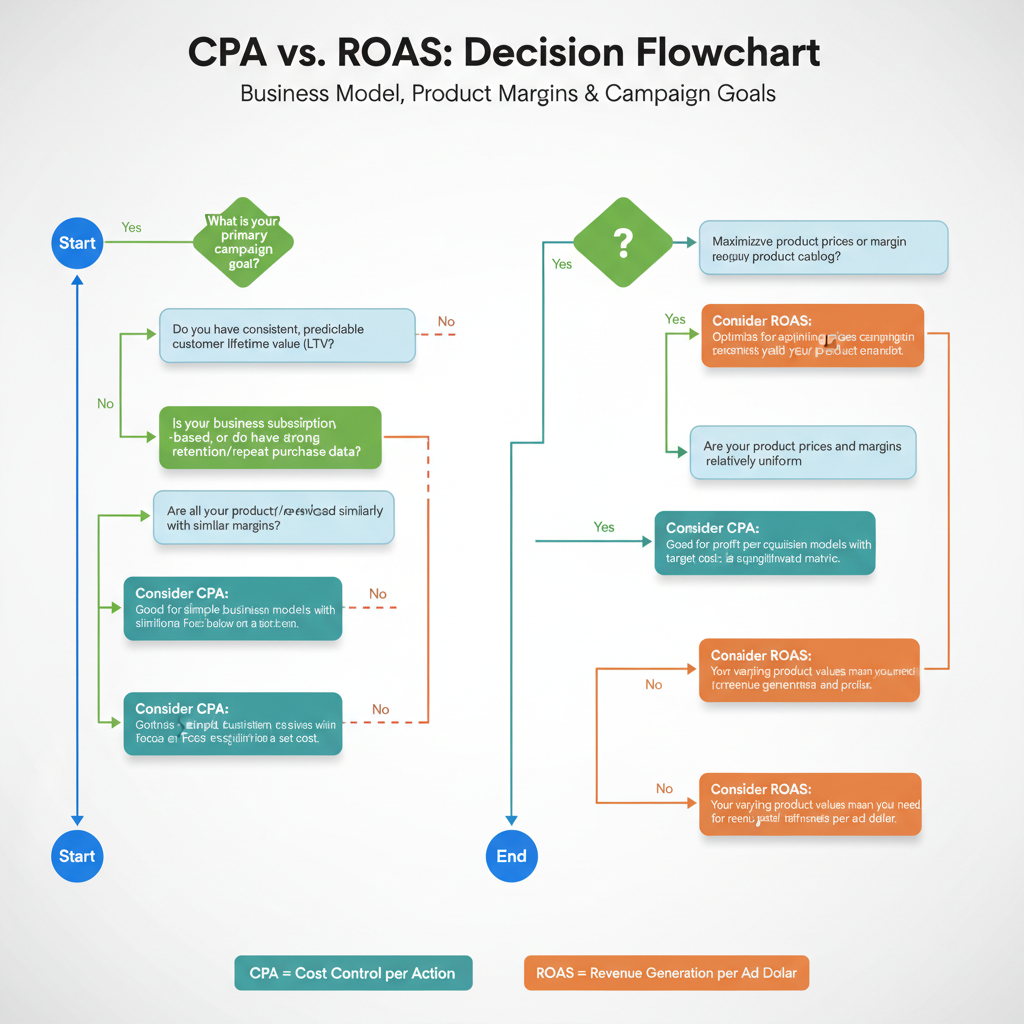

Start with these questions:1. Do conversion values vary by more than 30%? If yes → ROAS. If no → CPA.

2. Is revenue tracking properly implemented? If yes → ROAS is available. If no → CPA until tracking is ready.

3. What's your primary business goal? Revenue growth → ROAS. Customer acquisition → CPA. Profit growth → ROAS with margin awareness.

4. What's your campaign volume? High volume (50+ weekly conversions) → Either metric. Low volume → CPA initially.

5. What's your business model? Ecommerce → ROAS. Lead generation → CPA. SaaS → Depends on pricing structure.

Use our Budget Allocator to plan your campaign structure and budget distribution across different optimization goals.

The right metric makes algorithms work for your business objectives rather than against them. CPA optimization maximizes conversion volume within cost constraints, perfect for lead generation and consistent-value businesses. ROAS optimization maximizes revenue return, essential for ecommerce and variable-value models.

Most importantly, remember that your optimization metric should evolve as your campaigns mature, your tracking improves, and your business priorities shift. What starts as CPA optimization during campaign launch can transition to ROAS as you scale, or vice versa depending on market conditions and business needs.

Choose deliberately, monitor comprehensively, and adjust strategically. Your primary metric isn't permanent—it's a tool that should serve your current business reality and growth objectives.