Why Your CPM is Rising: Seasonality, Competition & Auction Dynamics Explained

You've been running the same campaigns with consistent performance for months. Then suddenly, without changing anything, your CPM jumps 30%, 50%, even 100%. Your cost per conversion doubles. Your ROAS collapses. What happened?

Rising CPMs are one of the most frustrating challenges in paid advertising because they feel arbitrary and uncontrollable. You're buying the same impressions from the same platforms targeting the same audiences, yet the price keeps increasing. Understanding why this happens—and what you can actually control—is essential for maintaining profitable campaigns in competitive markets.

This comprehensive guide explains the mechanics behind CPM fluctuations, reveals the seasonal patterns that drive predictable price increases, and provides strategic frameworks for minimizing CPM impact on your campaign performance.

How Ad Auction Dynamics Affect CPM

Every impression on Meta, Google, TikTok, and other advertising platforms is sold through a real-time auction. Understanding auction mechanics explains why CPMs fluctuate and what you can do about it.

The Second-Price Auction ModelMost ad platforms use second-price auctions where:

- Advertisers submit bids for impressions

- The highest bidder wins the auction

- The winner pays $0.01 more than the second-highest bid

This creates counter-intuitive dynamics. You don't pay what you bid—you pay what's necessary to beat the competition. When competition is light, you might bid $15 CPM but only pay $5. When competition is fierce, you might pay $14.99.

Your bid sets your maximum CPM, but actual CPM is determined by competitive pressure at the moment of each auction.

Platforms don't simply award impressions to the highest bidder. They calculate "total value" based on:

Total Value = Bid Amount × Quality ScoreQuality score incorporates:

- Relevance: How well your ad matches the user and context

- Expected engagement: Predicted click-through and interaction rates

- Landing page quality: User experience on your destination page

- Historical performance: Your account and campaign track record

This means two advertisers bidding the same amount may pay different CPMs based on quality scores. An advertiser with a 1.3 quality score effectively gets a 30% discount versus a 1.0 quality score competitor.

Why This Matters for CPM:- Competition drives price: When more advertisers compete for the same inventory, second-price dynamics push prices higher as each bidder needs to beat the next highest bid.

- Quality provides insulation: Higher quality scores reduce your effective CPM even when bid prices rise across the market.

- Real-time variation: Because auctions occur individually for each impression, CPMs fluctuate throughout the day based on competitive pressure at each moment.

- Budget constraints: When advertisers hit budget caps and exit auctions, competitive pressure (and CPMs) decrease.

CPM is ultimately a function of supply and demand:

CPM = (Advertiser Demand / Available Inventory) × Quality FactorsWhen demand increases (more advertisers competing) or supply decreases (fewer users online), CPMs rise. When demand decreases or supply increases, CPMs fall.

This explains daily and hourly CPM fluctuations:

- Evening hours: More users online (higher supply) but also more competition (higher demand) = moderate CPM increases

- Middle of night: Fewer users online (lower supply) but very low competition (lower demand) = moderate to low CPMs

- Weekend vs weekday: Varies by platform and audience, but generally lower competition on weekends = lower CPMs

- Business hours for B2B: Higher competition for professional audiences during working hours = higher CPMs

Platforms optimize campaign delivery to find the lowest-cost impressions that meet your objectives. When you set a $50/day budget, the platform might:

- Spend more during low-CPM hours

- Reduce spending during high-CPM hours

- Shift delivery to days with less competition

- Target audience segments with lower competitive pressure

This delivery optimization can mask CPM increases temporarily, maintaining performance while competitive dynamics change. Eventually, when low-cost inventory is exhausted, you see CPM increases reflected in campaign performance.

Understanding auction dynamics helps you recognize that CPM increases often reflect market forces beyond your control. The question becomes how to maintain performance despite these increases.

Use our CPM calculator to understand how CPM changes affect your overall campaign costs and budget requirements, and compare your CPM against industry benchmarks in our Advertising Benchmarks.

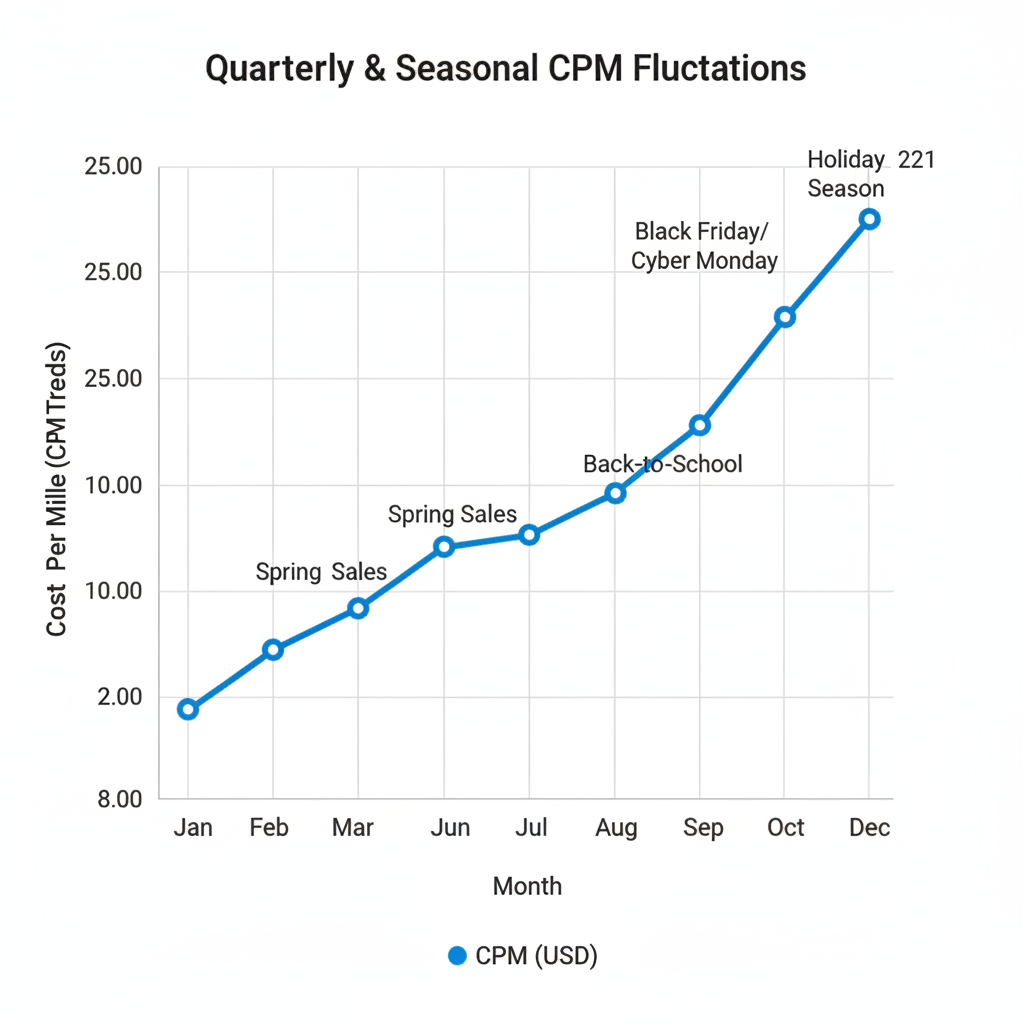

Seasonal CPM Trends by Industry

CPM fluctuations follow predictable seasonal patterns driven by advertiser demand cycles. Understanding these patterns allows you to plan budgets and expectations accordingly.

Q4 Holiday Season (October-December)The most expensive advertising period across nearly all industries. CPMs typically increase 50-150% compared to Q1 baseline.

Why CPMs spike:- Retail advertisers flood platforms for Black Friday, Cyber Monday, and holiday shopping

- Annual budgets get spent down before year-end

- Consumer spending intent peaks

- Competition for limited inventory intensifies

- Brands invest heavily to capture year-end revenue

- Peak competition for consumer attention

- Brands willing to accept lower ROI for volume

- Retargeting costs increase most dramatically

- Enterprise budget cycles drive Q4 spending

- Competition from retail bleeds into B2B inventory

- Post-December 15 costs often drop as budgets exhaust

- Home services advertising for holiday projects

- Financial services advertising for year-end planning

- Healthcare advertising for open enrollment periods

The cheapest advertising period in most industries. CPMs drop 30-60% from Q4 peaks.

Why CPMs drop:- Advertiser budgets haven't reset yet

- Post-holiday spending lull reduces consumer intent

- Competition drops dramatically

- Platforms have excess inventory

- Build audiences for later retargeting

- Test new creative and audiences at lower cost

- Acquire customers at best-of-year efficiency

- Build momentum before competition intensifies

Gradual CPM increases as budgets replenish and seasonal industries activate.

Why CPMs rise:- Annual budgets start flowing

- Spring spending seasonality in retail, home services, travel

- Graduation and summer season advertising begins

- Tax refund spending drives consumer categories

Variable patterns by industry. Generally moderate competition with localized spikes.

Why patterns vary:- Back-to-school drives retail CPM increases in July-August

- Travel and hospitality peak spending

- Many industries see summer slowdown

- B2B often slows due to vacation schedules

Beyond quarterly patterns, specific industries have unique seasonal dynamics:

Wedding industry: Peak CPMs January-March (engagement season) and May-June (wedding season planning) Real estate: Peak CPMs March-June (spring selling season) Education: Peak CPMs July-August (fall enrollment) and December-January (spring enrollment) Tax services: Peak CPMs January-April Fitness: Peak CPMs January (New Year's) and May-June (summer body) Financial services: Peak CPMs September-October (end of tax year planning) Seasonal Budget Planning:Build these patterns into your annual budget:

- Allocate 40-50% of annual budget to Q4 if retail/ecommerce

- Reserve 20-25% for Q1 efficiency opportunities

- Distribute remaining 30-35% across Q2-Q3

- Adjust based on your specific industry patterns

Anticipating seasonal CPM changes prevents performance anxiety when costs rise predictably and allows you to capitalize on low-cost periods strategically.

Competition and Market Saturation Impact

Beyond seasonal patterns, competitive dynamics in your specific market and audience segments drive CPM fluctuations.

Competitor Entry and ExitEvery time a competitor enters or exits the advertising market for your audience, CPMs shift:

New competitor enters:- Immediately increases competition for auctions

- CPM increases proportional to their budget size

- Effect is strongest in narrow/niche audiences

- May take weeks to see full impact as they scale

- Decreases competitive pressure

- CPMs drop proportionally

- Effect is immediate in real-time auctions

- Opportunities for budget expansion at lower costs

- Use Meta Ad Library and Google Ads Transparency Center to track competitor advertising presence

- Monitor CPM trends for unusual spikes or drops

- Track when major competitors launch campaigns (product releases, funding rounds, seasonal campaigns)

- Note competitive intensity changes after industry events

As markets mature, advertising costs inevitably rise due to:

Increasing advertiser sophistication: More advertisers running professional campaigns increases average quality scores, making it harder to differentiate through quality alone. Audience fatigue: Audiences in saturated markets see more ads, become less responsive, reducing engagement rates and forcing higher bids for conversions. Platform maturity: As platforms mature (TikTok 2020-2024 for example), early-adopter advantages disappear and costs normalize to market rates. Attribution inflation: Multiple advertisers using last-click attribution claim credit for the same conversions, leading to over-investment in lower-funnel tactics and driving up costs. Signs your market is becoming saturated:1. Steady CPM increases without seasonal explanation

2. Declining engagement rates on similar creative quality

3. Higher frequency required to drive same conversion rates

4. New audience segments performing worse than historical audiences

5. Increasing Cost Per Acquisition even with stable CPMs

Strategies for saturated markets: Creative differentiation: In saturated markets, creative quality becomes the primary competitive advantage. Invest more in creative development and testing. Audience expansion: Move beyond core audiences to reach less-saturated segments, even if they're slightly less qualified. Platform diversification: Test newer or less-saturated platforms (TikTok vs Meta, Pinterest vs Instagram, etc.) First-party data advantages: Build and use first-party data assets (email lists, customer lists, website visitor data) that competitors can't access. Upper-funnel investment: Shift budget to awareness and consideration campaigns where competition is lighter, then retarget. Vertical Integration: Control more of the customer journey (own content, own communities, own email lists) to reduce dependence on paid platforms. Market Position Affects CPM: Market leaders: Often pay premium CPMs because they have higher budgets and can afford to outbid competitors. They value market share over perfect efficiency. Market challengers: Face the worst CPM dynamics—competing against better-funded leaders without the scale advantages of market position. Niche players: Can sometimes find lower CPMs by targeting highly specific audiences that larger competitors ignore. Geographic Variation:CPMs vary dramatically by geography based on local competitive intensity:

United States: Highest CPMs globally due to high competition and high consumer spending power. National campaigns might see $15-30 CPM. Western Europe: Moderate-high CPMs ($8-18) with variation by country (UK higher, Eastern Europe lower). Developing markets: Lower CPMs ($2-8) but often lower conversion rates and average order values. Major metro areas: Higher CPMs than rural areas in same country due to competitive concentration.If your business can serve multiple geographies, testing lower-competition markets can dramatically reduce costs while maintaining volume.

Platform Algorithm Changes

Advertising platforms regularly update their algorithms, delivery systems, and auction mechanics. These changes can significantly impact CPMs, often with little warning or transparency.

Types of Algorithm Changes: Delivery Optimization UpdatesPlatforms continuously refine how they predict conversion probability and deliver ads. Changes intended to improve performance for most advertisers may hurt specific campaigns:

- Machine learning model updates may change how your audiences are valued

- Conversion prediction improvements may shift delivery to different audience segments

- Budget pacing changes may alter when your ads are shown

Privacy updates create structural CPM increases by reducing targeting precision:

iOS14.5+ ATT Framework (2021): Reduced Meta's ability to track conversions, forcing them to shift from deterministic to probabilistic attribution. This created:- Higher CPMs as targeting became less precise

- Longer learning phases requiring more data

- Reduced campaign efficiency for app-install and conversion campaigns

Platforms occasionally modify auction dynamics:

- Bid strategy changes: New bidding options or modifications to existing strategies

- Auction ranking factors: Changes to how quality scores are calculated

- Inventory allocation: Changes to how different objective types compete for inventory

These changes can shift which advertisers win auctions at what prices, sometimes creating sudden CPM movements.

Feature Launches and DeprecationsNew features often come with promotional CPM advantages to encourage adoption:

- Advantage+ campaigns (Meta): Initially offered lower CPMs to encourage adoption

- Performance Max (Google): Similar early-adopter advantages

- New placement types: New ad placements (Reels, Shorts, Stories when first launched) often had lower initial CPMs

Conversely, deprecated features often see CPM increases as inventory becomes limited:

- News Feed ads saw CPM increases as more inventory shifted to Stories and Reels

- Text ads on Google saw increases as responsive search ads became default

The most successful advertisers view algorithm changes as inevitable and build adaptive processes rather than rigid strategies. When a change impacts CPMs negatively, the question isn't "how do I get back to the old CPMs" but "how do I optimize performance within the new system."

Audience Targeting and CPM

Your targeting choices directly impact CPMs through supply-demand dynamics and competitive intensity. Understanding these relationships helps you make strategic targeting decisions.

Audience Size and CPMLarger audiences generally have lower CPMs due to:

- More available inventory: Less scarcity means lower competitive prices

- Delivery flexibility: Platform can optimize across more options

- Less competition: Broad audiences attract fewer specialized competitors

Smaller audiences have higher CPMs because:

- Inventory scarcity: Limited supply increases competitive pressure

- Concentrated competition: Specialized audiences attract specialized competitors all competing for the same limited impressions

- Less optimization flexibility: Platform has fewer delivery options

- Broad audience (5M people, general interests): $8 CPM

- Medium audience (500K, specific interests): $15 CPM

- Narrow audience (50K, highly specific lookalike): $35 CPM

Some audiences command premium CPMs because advertisers collectively recognize their high conversion potential:

High-CPM audiences:- C-suite executives and decision makers ($50-150 CPM)

- High-income households ($25-40 CPM)

- In-market for high-value purchases ($30-60 CPM)

- Recent purchasers/converters ($40-80 CPM in retargeting)

- Broad demographic targeting ($8-15 CPM)

- Interest-based targeting ($10-20 CPM)

- Lookalike audiences ($15-25 CPM)

- Geographic targeting only ($6-12 CPM)

The premium is often justified by higher conversion rates and average order values, but not always. Calculate whether high-CPM audiences actually deliver better ROAS or just appear more valuable.

Targeting Precision vs Cost Trade-offMore precise targeting creates higher CPMs but potentially better conversion rates. The question is whether improved conversion rate justifies increased CPM:

Scenario 1: Broad targeting- CPM: $10

- CTR: 1.5%

- Conversion rate: 2%

- Cost per conversion: $33.33

- CPM: $25

- CTR: 2.5%

- Conversion rate: 4%

- Cost per conversion: $25

The narrow targeting has 150% higher CPM but actually delivers 25% lower cost per conversion due to better engagement and conversion rates.

However, this isn't always the case:

Scenario 3: Over-targeted- CPM: $40

- CTR: 2.8%

- Conversion rate: 4.5%

- Cost per conversion: $31.75

This over-targeted audience has the highest CPM and highest conversion rate but worse cost per conversion than the medium-targeted option due to excessive CPM premium.

Optimal targeting balances:- Audience quality (conversion rate)

- Audience cost (CPM)

- Audience size (scale potential)

Use our CPA calculator to determine whether higher-CPM audiences deliver better or worse cost per acquisition.

Retargeting CPM DynamicsRetargeting audiences create unique CPM dynamics:

Advantages:- Higher relevance scores lower effective CPMs

- Smaller audiences mean budgets don't compete with full force

- Higher conversion rates justify higher CPMs

- Multiple advertisers retargeting same users (especially cart abandoners)

- Limited inventory can't absorb large budgets

- Over-frequency can increase CPMs as platform struggles to find fresh inventory

- Website visitors (broad, 30 days): 80-120% of prospecting CPM

- Page viewers (specific products): 100-150% of prospecting CPM

- Cart abandoners: 150-250% of prospecting CPM

- Purchaser audiences: 200-400% of prospecting CPM

The higher CPMs are usually justified by dramatically higher conversion rates, but monitor to ensure cost per conversion remains favorable.

Lookalike Audience Quality DecayLookalike audiences show increasing CPMs as you expand from 1% to 10%:

- 1% Lookalike: Highest CPM, most similar to source audience

- 5% Lookalike: Medium CPM, moderate similarity

- 10% Lookalike: Lowest CPM, approaching broad targeting

Counter-intuitively, 1% lookalikes often deliver best ROAS despite higher CPMs because the audience quality premium exceeds the cost premium.

Geographic Targeting ImpactAs mentioned in competition section, geography dramatically affects CPM:

High-CPM geographies:- United States (especially major metros): $15-35 CPM

- United Kingdom, Australia, Canada: $12-25 CPM

- Western Europe: $10-20 CPM

- Eastern Europe: $5-12 CPM

- Latin America: $4-10 CPM

- Southeast Asia: $3-8 CPM

- India: $1-4 CPM

- Africa: $1-3 CPM

If your business model works in multiple geographies, testing lower-CPM markets can dramatically reduce costs while maintaining volume.

Creative Performance Effect on CPM

Your ad creative directly impacts CPM through quality score mechanics and engagement rates. Better creative doesn't just improve conversion rates—it reduces what you pay for impressions.

Creative Quality Score ImpactPlatforms reward engaging creative with higher quality scores, which reduce effective CPM:

High-quality creative (relevant, engaging, good user experience):- Quality score multiplier: 1.2-1.5×

- Effective CPM reduction: 17-33%

- Better auction positions at same bid

- Quality score multiplier: 1.0×

- No CPM advantage or disadvantage

- Pay market rates

- Quality score multiplier: 0.7-0.9×

- Effective CPM increase: 11-43%

- Lose auctions to competitors with better creative

Two advertisers bid $20 CPM for the same impression:

Advertiser A with quality score 1.3: Total value = $26, pays $15.01Advertiser B with quality score 1.0: Total value = $20, pays $13.34

Advertiser A wins the auction but pays only $15.01 (the second-highest total value divided by their quality score) despite having a lower base bid than their total value.

This demonstrates how creative quality provides competitive advantages beyond just conversion rates—it literally reduces what you pay for impressions.

Engagement Rate EffectsHigher engagement rates signal creative quality and improve quality scores:

High-engagement creative:- 3-5%+ CTR or engagement rate

- Platform shows ads more frequently

- CPMs often 20-40% lower than account average

- Extended creative lifespan before fatigue

- <0.5% CTR or engagement rate

- Platform reduces delivery

- CPMs often 30-60% higher than account average

- Quick creative fatigue

This creates a positive feedback loop where good creative → high engagement → lower CPM → better ROAS → more budget → more delivery.

Conversely, poor creative → low engagement → higher CPM → worse ROAS → budget cuts → reduced delivery.

Creative Fatigue and CPMAs audiences see the same creative repeatedly, engagement rates decline and CPMs increase:

Week 1: Fresh creative- High engagement

- Low CPM

- Strong performance

- Stable engagement

- Stable CPM

- Consistent performance

- Declining engagement

- Increasing CPM

- Degrading performance

The timeline varies by audience size and budget:

- Small audiences (<100K): Fatigue in 7-14 days

- Medium audiences (500K): Fatigue in 3-5 weeks

- Large audiences (5M+): Fatigue in 6-10 weeks

- CPM increasing 20%+ from baseline

- CTR decreasing 30%+ from peak

- Frequency above 4-5

- Conversion rate declining despite stable CPM

- Small audiences: New creative every 2 weeks

- Medium audiences: New creative every 4 weeks

- Large audiences: New creative every 6-8 weeks

Different creative formats have different CPM dynamics:

Video creative:- Often lower CPMs (15-30% less) due to higher engagement potential

- Higher production costs offset CPM savings

- Better storytelling capabilities

- Platform favoritism in algorithms (especially Meta, TikTok)

- Higher CPMs but lower production costs

- Faster to produce and iterate

- Better for direct response offers

- Still effective despite higher costs

- Medium CPMs between video and static

- Good for showcasing multiple products

- Higher engagement than static, lower production cost than video

Test multiple formats to find optimal balance of CPM, engagement, conversion rate, and production efficiency for your business.

Landing Page Experience ImpactYour landing page quality affects ad platform quality scores and CPMs:

High-quality landing pages:- Fast load times (<2 seconds)

- Mobile-optimized design

- Clear value proposition

- Low bounce rates

Result: 10-20% lower CPMs through quality score improvements

Poor landing pages:- Slow load times (>4 seconds)

- Poor mobile experience

- Confusing navigation

- High bounce rates

Result: 20-40% higher CPMs through quality score penalties

Platforms increasingly factor post-click experience into quality calculations, making landing page optimization an important CPM reduction tactic.

Strategies to Combat Rising CPMs

When CPMs rise due to seasonality, competition, or algorithm changes, you're not powerless. These strategies help maintain performance despite increasing costs.

Strategy 1: Improve Creative QualityThe most direct CPM reduction method is improving creative quality to increase quality scores:

Action steps:- Develop 5-10 new creative variations monthly

- Test different formats (video, static, carousel)

- Use platform best practices (TikTok native style, Meta thumb-stopping hooks)

- Refresh creative before fatigue sets in

- Test different hooks, offers, and angles

When narrow audiences become too expensive, strategic expansion can reduce CPMs while maintaining performance:

Action steps:- Expand lookalike percentage (1% → 3% → 5%)

- Add broader interest targeting alongside narrow targeting

- Test geographic expansion to lower-cost markets

- Use platform automated targeting (Advantage+ audiences)

- Remove excessive layering of targeting criteria

Different placements have different CPM profiles:

Typical Meta placement CPMs (relative):- Instagram Stories: 100% (baseline)

- Facebook Feed: 120%

- Instagram Feed: 110%

- Facebook Right Column: 60%

- Audience Network: 40%

- Messenger: 70%

Test performance across placements and shift budget toward placements with favorable CPM/conversion rate ratios.

Expected impact: 15-40% CPM reduction depending on placement mix Strategy 4: Timing OptimizationBid more aggressively during low-CPM periods and reduce during high-CPM periods:

Action steps:- Use dayparting to focus on low-CPM hours if conversion rates hold

- Increase budgets during off-seasons (Q1) and reduce during peak seasons (Q4)

- Run campaigns Sunday-Thursday if weekend CPMs are higher

- Pause or reduce during known high-competition periods

When one platform's CPMs rise, test alternatives. Use our Platform Comparison Tool to evaluate CPM differences, audience overlap, and conversion potential across platforms:

If Meta CPMs rise:- Test TikTok (often 30-50% lower CPM)

- Test Pinterest (lower CPM for visual products)

- Test Snapchat (lower CPM for young audiences)

- Test Microsoft Ads (often 20-40% lower CPC)

- Test Amazon Ads (if ecommerce)

- Test programmatic display

When conversion campaign CPMs are prohibitive, shift strategy:

Action steps:- Run traffic or engagement campaigns at 40-60% lower CPM

- Build audience pools for retargeting

- Convert through retargeting campaigns or email nurture

- Accept longer attribution windows

Reduce CPMs through quality score improvements:

Action steps:- Optimize page speed (target <2 seconds)

- Improve mobile experience (test on real devices)

- Clarify value proposition in hero section

- Reduce friction in conversion path

- A/B test landing page variations

For large budgets, explore managed or reservation buying:

Action steps:- Contact platform sales representatives

- Explore managed service options

- Negotiate fixed-CPM deals for large commitments

- Test private marketplace deals (programmatic)

Use first-party data assets competitors can't access:

Action steps:- Upload customer lists for targeting and lookalikes

- Create custom audiences from website visitors

- Build email-based retargeting segments

- Use offline conversion data for optimization

Sometimes CPM increases are market-wide and unavoidable. Focus on conversion optimization instead:

Action steps:- Improve on-site conversion rate (bigger impact than CPM reduction)

- Increase average order value through bundles and upsells

- Reduce other costs (shipping, COGs) to improve margins

- Adjust pricing if market supports it

Combine multiple strategies for cumulative impact:

Example combination:

- Improve creative quality: -20% CPM

- Broaden targeting: -15% CPM

- Optimize timing: -10% CPM

- Improve landing pages: -15% CPM

Cumulative effect: ~50% CPM reduction from baseline (not quite additive due to overlaps, but substantial)

The key is viewing rising CPMs not as unavoidable cost increases but as optimization opportunities. Markets become more efficient over time, but strategic advertisers find advantages through creative excellence, targeting strategy, technical optimization, and platform diversification.

Managing CPM in Competitive Markets

In highly competitive markets, CPM management becomes a continuous discipline rather than occasional optimization. Build these practices into your regular campaign management:

Weekly CPM Audits:Review CPM trends weekly:

- Identify campaigns with 20%+ CPM increases

- Diagnose cause (creative fatigue, competition, seasonality, algorithm change)

- Implement appropriate response based on diagnosis

- Track whether interventions improve CPMs

Maintain continuous creative production:

- Develop 10-15 new creatives monthly

- Test 5-8 new concepts weekly

- Retire bottom 20% of creatives by engagement

- Promote top 20% with increased budget

This ensures fresh creative is always available to combat fatigue-driven CPM increases.

Competitive Intelligence:Monitor competitive activity:

- Use Meta Ad Library to track competitor creative

- Note when major competitors launch or pause campaigns

- Track industry events that drive advertising spikes

- Adjust budgets and bids based on competitive intensity

Build CPM seasonality into annual plans:

- Allocate 40-50% of budget to high-CPM seasons if that's when revenue concentrates

- Reserve 20-25% for low-CPM seasons to build audiences

- Adjust monthly budgets ±30% from average based on expected CPM patterns

- Set quarterly ROAS targets accounting for seasonal CPM variation

Maintain active presence on multiple platforms:

- Prevents over-dependence on single platform's pricing dynamics

- Allows budget shifting when one platform CPMs spike

- Provides competitive leverage in managed service negotiations

- Diversifies against algorithm change risk

Treat quality score as a primary KPI alongside ROAS:

- Track engagement rates as proxy for quality

- Benchmark quality scores when platforms provide data

- Optimize specifically for quality improvements, not just conversions

- Recognize that quality score improvements reduce costs permanently

Build robust data collection and analysis:

- Track CPM alongside all other metrics in dashboards

- Segment CPM analysis by audience, creative, placement, time

- Identify patterns in CPM variation

- Use data to inform optimization priorities

Rising CPMs are inevitable in competitive markets, but they're manageable with systematic approaches that combine creative excellence, strategic targeting, timing optimization, and platform diversification. The advertisers who succeed long-term are those who build CPM management into their operational discipline rather than treating it as a crisis when costs spike.

Understanding why your CPM is rising—whether from seasonality, competition, algorithm changes, audience saturation, or creative fatigue—allows you to implement appropriate responses rather than reacting blindly to performance changes. Each cause requires different solutions, and accurate diagnosis is half the battle.

Start by establishing baseline CPM expectations for your industry and seasonality patterns, monitor weekly for significant deviations, diagnose root causes when increases occur, and implement targeted strategies based on that diagnosis. This systematic approach transforms CPM from a mysterious force that controls your profitability into a manageable variable that you can influence through strategic and tactical decisions.