Ecommerce Ad Budget Planner: Calculate Your Monthly Advertising Spend

Strategic budget planning is the foundation of sustainable ecommerce growth. Without a clear understanding of how much to spend on advertising and where to allocate those dollars, you're essentially flying blind—hoping for results rather than engineering them. This comprehensive guide will walk you through proven budget planning methodologies specifically designed for ecommerce businesses at every stage of growth.

Whether you're launching your first ad campaigns with a modest budget or scaling to seven figures in monthly ad spend, the principles and frameworks in this article will help you make data-driven decisions about your advertising investments.

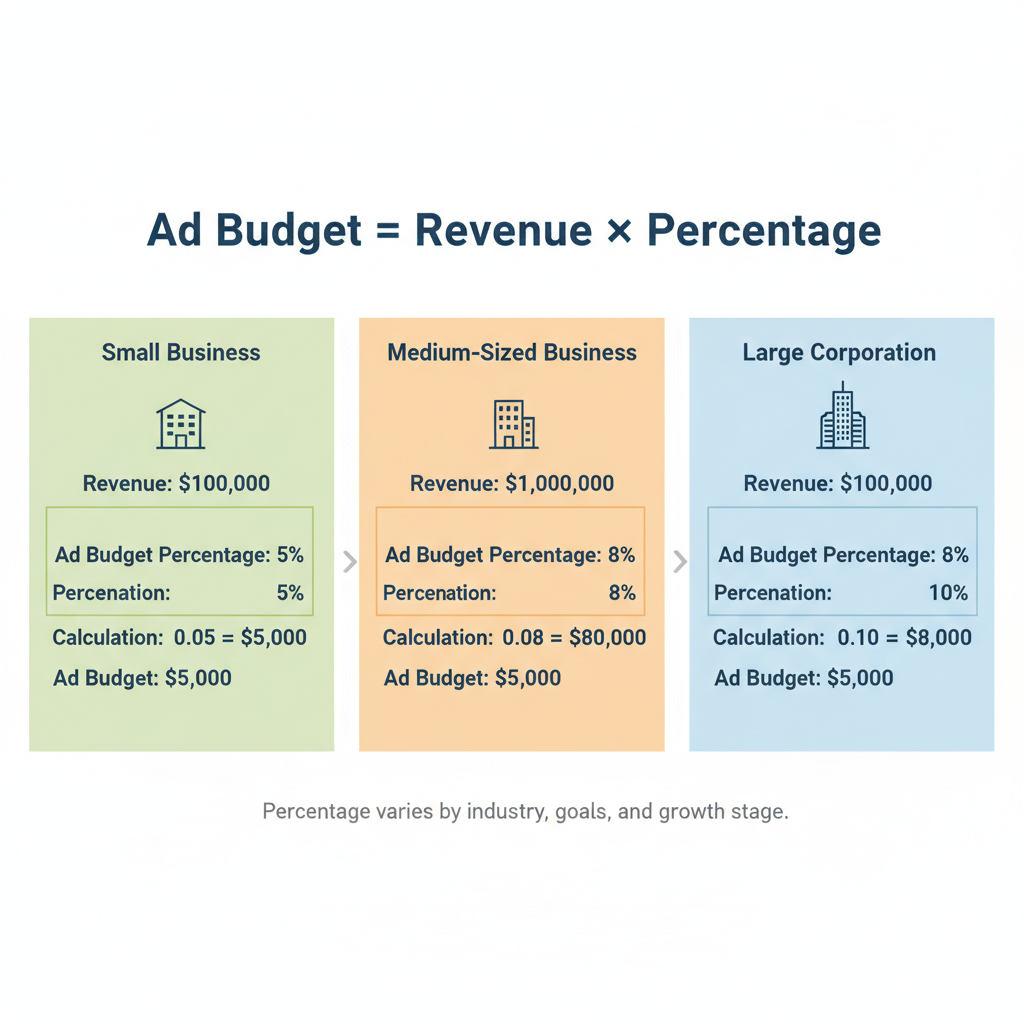

Revenue-Based Budget Planning Methods

The most common question ecommerce brands ask is: "What percentage of revenue should I spend on advertising?" While there's no universal answer, industry benchmarks provide valuable starting points.

The Standard Revenue Percentage MethodMost successful ecommerce businesses allocate between 10-30% of their total revenue to advertising, with the exact percentage depending on several factors:

- New brands (0-12 months): 20-40% of revenue

- Growth stage (1-3 years): 15-25% of revenue

- Mature brands (3+ years): 10-15% of revenue

- Aggressive growth mode: 30-50% of revenue

The revenue percentage method works because it automatically scales your ad spend with your business size. When revenue is $10,000/month, a 20% budget means $2,000 in ad spend. When you grow to $100,000/month, that same 20% becomes $20,000—providing the fuel needed for continued expansion.

The Profit Margin ApproachA more sophisticated method factors in your actual profit margins. If your average product margin is 40%, you have more room for advertising spend than a business with 20% margins.

Calculate your maximum sustainable ad spend:

For example, if you have 50% gross margins and want to maintain 15% net profit:Maximum Ad Spend = (50% - 15%) / 2 = 17.5%Maximum Ad Spend = (50% - 15%) / 2 = 17.5%- Set your monthly revenue target

- Determine your average order value (AOV)

- Calculate orders needed: Target Revenue / AOV

- Multiply by your target CPA (cost per acquisition)

- Add 20% buffer for testing and optimization

Orders needed: $100,000 / $80 = 1,250 ordersBase ad budget: 1,250 × $30 = $37,500- With 20% buffer: $45,000/month

Customer Acquisition Cost Target Setting

Understanding and setting appropriate Customer Acquisition Cost (CAC) targets is critical for profitable budget planning. Your CAC should be based on Customer Lifetime Value (LTV), not arbitrary numbers. The LTV:CAC Ratio Healthy ecommerce businesses maintain specific LTV:CAC ratios:- Minimum acceptable: 3:1 (for every $1 spent acquiring customers, you earn $3 in lifetime value)

- Good performance: 4:1 to 5:1

- Exceptional: 6:1 or higher

- Too high: Above 10:1 (suggests you're under-investing in growth)

Maximum CAC = Customer Lifetime Value / Target RatioMaximum CAC = $200 / 4 = $50Product Margin Considerations

Not all products deserve equal advertising budget. Strategic budget allocation by product margin can dramatically improve overall profitability. Margin-Based Budget Allocation Group your products into margin tiers:- Premium margin (50%+): 40-50% of ad budget

- Good margin (35-50%): 30-35% of ad budget

- Standard margin (20-35%): 15-20% of ad budget

- Low margin (<20%): 0-10% of ad budget (loss leaders only)

Break-Even ROAS = 1 / Gross Profit MarginBreak-Even ROAS = 1 / 0.25 = 4.0Growth Stage Budget Allocation

Your business stage should fundamentally influence budget allocation strategy. Launch Stage (Months 1-6) Priority: Learning and validation- 60% to conversion campaigns (testing audiences and offers)

- 25% to retargeting (capturing warm traffic)

- 15% to awareness (building initial brand recognition)

- 50% to proven conversion campaigns

- 25% to retargeting and email/SMS acquisition

- 15% to audience expansion

- 10% to new channel testing

- 40% to evergreen conversion campaigns

- 30% to customer retention and upsells

- 20% to brand awareness and market positioning

- 10% to innovation and new channel testing

Seasonal Budget Adjustments for Ecommerce

Ecommerce is inherently seasonal. Static monthly budgets leave money on the table during peak periods and waste it during slow months. Seasonal Budget Multipliers Apply these multipliers to your base monthly budget: Q4 Holiday Season (Oct-Dec)- October: 1.5x base budget

- November: 2.5-3.0x base budget (Black Friday/Cyber Monday)

- December: 2.0x base budget

- January: 0.7x base budget (post-holiday slowdown)

- February: 0.8x base budget

- March: 1.0x base budget

- April: 1.0x base budget

- May: 1.1x base budget

- June: 1.2x base budget (summer preparation)

- July: 1.3x base budget (back-to-school preparation)

- August: 1.4x base budget

- September: 1.2x base budget

- Calculate your annual budget ($120,000 example)

- Identify your peak months (Nov-Dec)

- Reduce slow month budgets by 30%

- Add those savings to peak month budgets

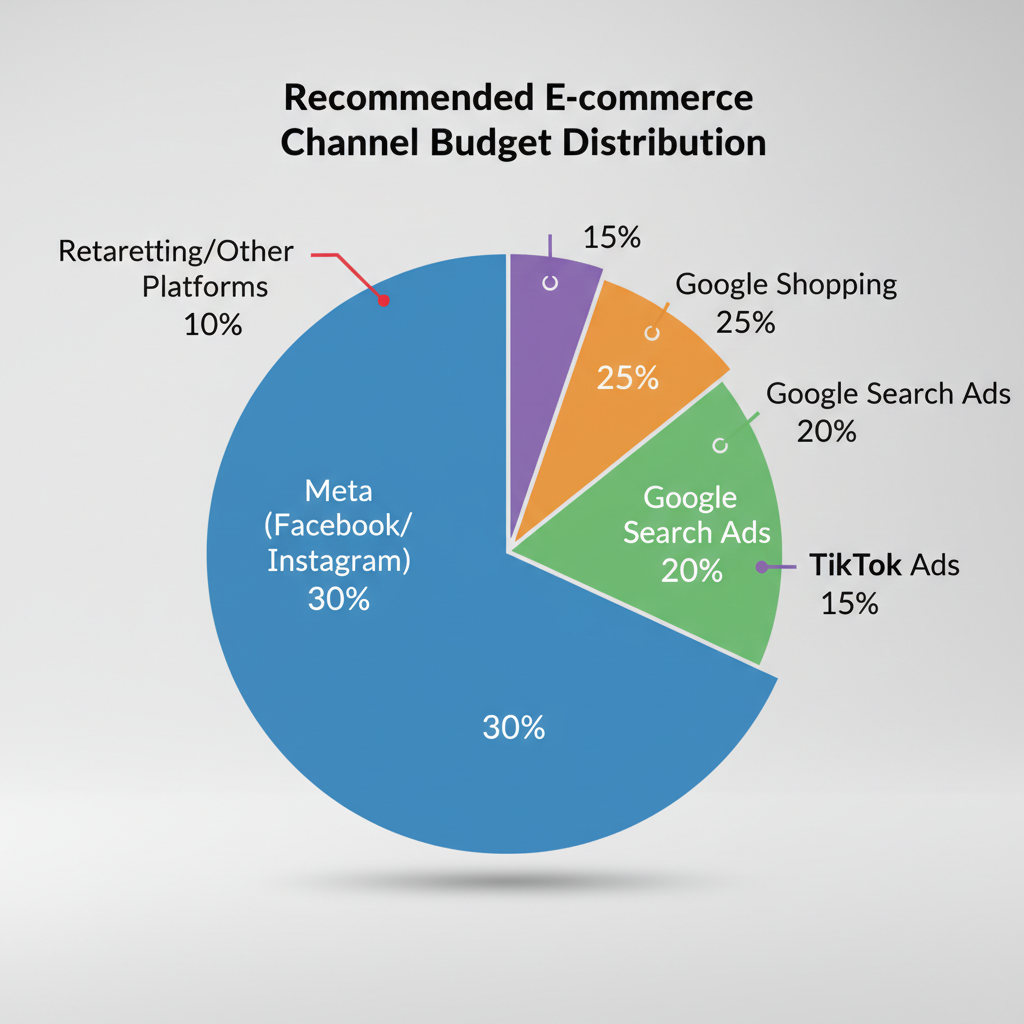

Channel Mix for Ecommerce Brands

- Meta (Facebook/Instagram): 35-40%

- Google Shopping: 25-30%

- Google Search: 15-20%

- Retargeting (all platforms): 10-15%

- TikTok/Emerging Platforms: 5-10%

- Meta: 40-45%

- TikTok: 20-25%

- Google Shopping: 15-20%

- Pinterest: 10-15%

- Retargeting: 10%

- Google Search: 40-45%

- Google Shopping: 25-30%

- Meta: 15-20%

- Retargeting: 10-15%

- Display/Video: 5%

- Meta: 30-35%

- Google Shopping: 20-25%

- YouTube: 15-20%

- Retargeting: 15-20%

- Premium Display: 10-15%

Interactive Ecommerce Budget Calculator

To calculate your optimal monthly advertising budget, work through this framework:Step Determine Your Base Budget

Choose your method:- Revenue-based: Current monthly revenue × 15-25%

- Goal-based: (Target orders × Target CPA) × 1.2

- Available capital: Maximum affordable monthly spend

Step Verify Against Profit Margins

Maximum Sustainable Budget = Monthly Revenue × (Gross Margin - Desired Net Margin)Step Apply Growth Stage Modifier

- Launch stage: Start with minimum $2,000/month

- Growth stage: Plan for 20-30% monthly increases

- Mature stage: Stabilize at proven efficient levels

Step Allocate Across Channels

Use the channel mix percentages from the previous section based on your business type.Step Apply Seasonal Adjustments

Multiply by seasonal factors for each month to create your 12-month budget plan. Example Calculation: Monthly revenue: $50,000 Gross margin: 45% Desired net margin: 15% Stage: GrowthBase budget (20% of revenue) = $10,000Maximum sustainable = $50,000 × (45% - 15%) = $15,000Monthly budget = $10,000 (within sustainable range)- Meta: $3,500

- Google Shopping: $2,500

- Google Search: $2,000

- Retargeting: $1,500

- TikTok testing: $500

Building Your Annual Advertising Budget Plan

Converting monthly budgets into an annual plan provides strategic clarity and financial predictability. Annual Budget Planning Template Create a 12-month spreadsheet with these components: Revenue Projections- Base monthly revenue

- Growth rate assumptions (be conservative)

- Seasonal adjustments

- Base monthly ad spend

- Seasonal multipliers

- Total monthly budgets

- Percentage allocation by channel

- Dollar amounts by channel

- Month-over-month changes

- Target ROAS by month

- Expected orders

- Projected customer acquisition costs

- 10-15% of annual budget

- Used for unexpected opportunities or testing

- Q1: $27,000 (17%)

- Q2: $36,000 (23%)

- Q3: $42,000 (27%)

- Q4: $51,000 (33%)

- Compare actual vs. planned spend

- Evaluate ROAS performance

- Identify over/under-performing channels

- Adjust future months based on learnings

- Reallocate budget from weak to strong performers

Target pace % = (Days elapsed / Days in month) × 100Actual pace % = (Spend to date / Monthly budget) × 100If actual pace exceeds target pace by >10%, you're overspending. If it's >10% under, you're leaving opportunity on the table.

Emergency Budget AdjustmentsBuild flexibility for mid-month adjustments:

- Keep 20% of budget uncommitted until mid-month

- Create rapid response protocols for breakout campaigns

- Define clear criteria for emergency budget increases

- Set maximum overspend thresholds (typically 25% over plan)

The most successful ecommerce brands treat budgets as dynamic tools rather than rigid constraints, adjusting based on real-time performance while maintaining overall fiscal discipline.

Long-Term Budget ScalingPlan your budget growth trajectory:

- Year 1: Establish baseline efficiency

- Year 2: Scale budget 150-200% of Year 1

- Year 3: Scale budget 200-300% of Year 1

- Year 4+: Scale based on market opportunity and capital efficiency

This scaling assumes you're maintaining or improving ROAS as you grow. If efficiency declines, address that before increasing budgets.

Strategic budget planning transforms advertising from a cost center into a predictable growth engine. By systematically considering your revenue, margins, growth stage, seasonality, and channel mix, you create a blueprint for sustainable ecommerce success.

The difference between businesses that scale profitably and those that burn through cash often comes down to this fundamental discipline: spending the right amount, in the right places, at the right times. Use the frameworks in this guide to build your own strategic budget plan, then execute with consistency while remaining flexible enough to capitalize on opportunities as they emerge.

Remember that the best budget plan is the one you can actually afford and sustain. Conservative planning with room for opportunistic scaling beats aggressive budgets that force you to pull back mid-quarter. Start with what's sustainable, prove efficiency, then systematically increase investment as you validate returns.